The deal is done – but the work isn’t over. Now, you have to integrate your newly acquired company. Post-M&A integration is the final step in your acquisition process.

Let’s explore what it takes to integrate the data from the acquired company into a new entity – whether that’s your private equity portfolio or an existing business – including the challenges that arise and the opportunities for value creation this process presents.

Post-M&A Integration Challenges

Time to value is critical during post-M&A integration. Buyers want results and aim to minimize potential setbacks that might deter an acquisition from operating at the desired level.

Data and technology play a significant role here, often becoming pain points, such as:

Messy and Inconsistent Data. Acquired companies often come with dirty data and disparate systems that aren’t ready to guide or track integration efforts. Imagine disorganized databases and spreadsheets spread across various platforms and departments.

Compounded Complexity. Data and technology challenges are magnified when multiple entities are involved, such as in the case of a roll-up or if two companies are merging post-acquisition. More platforms and processes mean more data and challenges.

Delayed Value Creation. There’s also the assumption that data remains inaccessible, inaccurate, or unclean until the tech stacks of these companies are integrated and implemented, leaving leadership in the dark for a year or more.

Because of these challenges, integration efforts experience a slowdown, creating frustration, extending the runway for getting newly acquired companies up and running… and creating value.

Data Turnaround Streamlines the Process

Data itself – and its appropriate handling – solves these challenges. Through data turnaround, a term we’re not coining but are using in a unique way, we help streamline post-M&A integration and transform data into a valuable asset earlier in the process.

Data turnaround refers to cleaning, centralizing, and leveraging unstructured data and activating it early in the integration process.

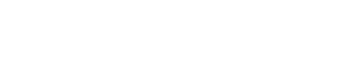

Here are the key components of our framework:

1. Centralizing data in a cloud-based data warehouse.

We pull legacy data from all platforms into a central location: a cloud-based data warehouse. In this environment, data can quickly be cleaned, organized, and made operationally useful.

2. Iterative cleaning and structuring of data for immediate use.

We clean and structure the data from the moment we pull it into storage, allowing leadership to use the most valuable information right away.

3. Highlighting actionable insights throughout the integration process.

As the data improves, its utilization expands, transforming it into a fully optimized asset. Eventually, early insights turn into a wide array of strategic actions.

So, how does this data become useful immediately? Here are just a few examples.

Tracking the Integration Process. Leadership can use the data to measure the effectiveness of integration initiatives in real time. Are the steps they’ve taken so far working?

Staffing and Organizational Planning. Integration often involves making key staffing decisions. Data helps determine retention, inform hiring strategies, and develop new organizational structures and roles.

Revenue Growth. Data-driven insights can guide strategic sales efforts, identifying opportunities for growth in specific markets, industries, or regions.

Operational Efficiency. The data can enhance efficiencies in critical areas like supply chain management, order fulfillment, and labor utilization, ensuring the company runs smoothly from day one.

Data is an asset and an accelerator. The data turnaround approach creates useable data while integration is ongoing, so leadership is always informed about where the acquisition and business stand.

infoFluency exists to make business data useful and meaningful. Data turnaround is just one of the services we offer private equity firms and enterprise companies to ensure data quality and activate business intelligence. Interested in learning more?